This means if you are paying RM1464 installment part of the portion RM950 will go to the interest and the balance RM1464-950 RM514 will deduct the principal. Public Bank Housing Loan Interest Rates- Best Home Loan Interest Rate 290.

Latest Base Rate Base Lending Rate Malaysia Housing Loan

5 Legal Fees And Stamp Duty Charges.

. Buying A New Home. Zero Moving Cost Home Loan Malaysia is one of the available home loan packages other than the Finance Entry Cost and. Interest rates for home loans in Malaysia are based on Base Rates BR which lay out the minimum interest rate banks give on home loans.

We have The Best Home Loan Rate Malaysia to announce todayWe do love when there is a new Home Loan promotion and we know you will too. Malaysia Lending Interest Rate is at 394 compared to 488 last year. Employment Governance and Policy Governmental Statistics Public Health Social.

Its fast and easy apply online today. Zero Moving Cost Home Loan Malaysia 2022 is a home loan package where the bank absorbs all the moving costs. 8 hours agoInterest rates for housing loans in Malaysia are generally quoted as a percentage below the Base Rate BR.

Since the announcement of a lower OPR in early July all the banks are starting to lower down their BR and home loan interest rates. Youve got questions Weve got answers. Remaining loan amount after the first 10 years RM361549.

Interest rates for housing loans in Malaysia are usually quoted as a percentage below the Base Rate BR. Best Low Interest Rate Housing Loansin Malaysia 2022. Browse through a vast selection of bank loan packages using our mortgage tool.

The moving cost included legal fees stamp duty disbursement fees and valuation fees. Buying A New Home. From the above you can see that refinancing with the new housing loan saves you RM116 every month or a total of RM27840 in interest savings.

Take one of these low interest home loans and you could be paying a lot less for your new house over the lifetime of your mortgage. Best Low Interest Rate Housing Loans. OCBC announced a New OCBC Home Loan Promotion.

How the help. Legal fees for the loan agreement. For example if the current lending rate is 66 the interest rate on a BLR 21 loan would be 45.

For example if the current BR rate is 400 Update. Its important to note that the initial home loan repayments will primarily be used to pay down the interest on your. Bank Fixed-Rate Home Loan Interest Rates.

When you take out a housing loan in Malaysia there will be legal fees and stamp duty charges youll need to account for. Malaysia Housing Loan Interest Rates. Base Lending Rate BLR 66 Maximum Loan Amount 90 of property price.

You can check the home loan interest rates and fill in the home loan application using home loan calculator apps. Term Loans with Optional Overdraft Semi-Flexi and Full-Flexi Packages. May 18th 2022 0 Comments.

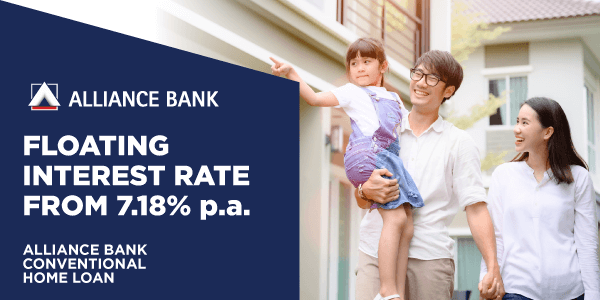

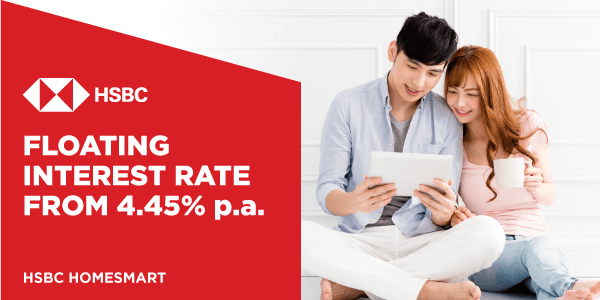

For example if the current BR rate is 400 the interest rate on a BR 045 loan would be 445. Another one in the list that offers a flexible home loan package is Maybank. 1 for first RM500000 of the loan 08 for the next RM500000 and 05 07 for subsequent amounts.

A tiny cut in interest rate of 025 might result in a saving of tens of thousands of ringgit over thirty years so make. In Malaysia the maximum loan tenure is 35 years or until the borrower turns 70 years old whichever comes earlier. At the time of writing the average base rates of Malaysian banks are between 175 275 pa.

As of 2nd January 2015 Base Lending Rate BLR has been updated to Base Rate BR to reflect the recent changes made by Bank Negara Malaysia and subsequently by major local banks the interest rate on a BR. Essentially interest is like rent on money. Petaling Jaya Main Branch 50-52 Jalan Sultan 524 46200 Petaling Jaya 46730 Petaling Jaya Selangor Malaysia.

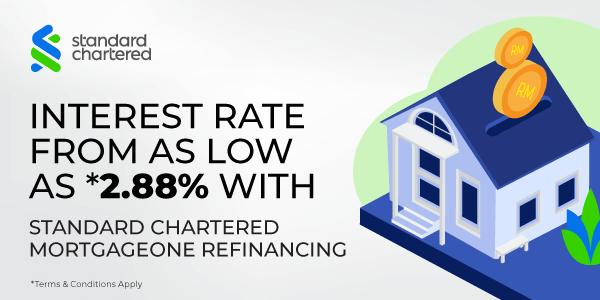

Monthly repayment RM2191. Best Home Loan Rates -OCBC Home Loan Interest Rate 300. 44 BR - 365 Hong Leong Housing Loan.

RM380000 x 3 RM11400. Interest Rate as up to 290 -pa. In Malaysia housing loan interest rates are usually quoted as a percentage above or below the Base Lending Rate BLR.

Bank Name Home Loan Interest Rate. This is the total interest youll pay for one year. These fees and charges include.

Our article on housing loan interest rates shows you the latest lending rates of Malaysian banks as well as a. Contact Us At 6012-6946746. Generally the loan tenure is dependent on your age the younger you are the longer your loan tenure.

Interest is a fee charged by banks for lending you money. 465 BR - 39 Citibank FlexiHome Loan. Its make borrowing cheaper and more affordable.

And they have limited quota on this. Let divide to monthly. Interest rate 64 24 4.

This is lower than the long term average of 708.

Online Calculator Malaysia Calculator Com My

Finance Malaysia Blogspot Update Local And Foreign Banks Mortgage Loan Rate As Of 6 March 2020

Best Housing Loans In Malaysia 2022 Compare And Apply Online

Best Low Interest Rate Housing Loans In Malaysia 2022 Compare And Apply Online

Latest Base Rate Base Lending Rate Malaysia Housing Loan

Lppsa An Easy Housing Loan Guide For Government Workers New Property Nuprop

2019 Bank Mortgage Interest Rates Malaysia

2019 Bank Mortgage Interest Rates Malaysia

Malaysia Property Progressive Payment Schedule Mypf My

Malaysia Lending Interest Rate Data Chart Theglobaleconomy Com

The 7 Best Housing Loans In Malaysia 2022

Best Housing Loans In Malaysia 2022 Compare And Apply Online

Bangkok Bank Al Rajhi Bank Bank Muamalat Have Highest Indicative Effective Lending Rates While Alliance Bank Public Bank Bsn Have Lowest The Edge Markets

Mygov Managing Finance And Taxation Getting A Loan Financing Getting A Home Loan Public Sector Home Financing Information

2019 Bank Mortgage Interest Rates Malaysia

New Reference Rate In Malaysia Effective 2nd January 2015 Base Rate Br

Best Housing Loans In Malaysia 2022 Compare And Apply Online

6 Ways To Reduce Your Mortgage Repayment Faster

How To Calculate Flat Rate Interest And Reducing Balance Rate